Hello Value Investing Students, Alumni, and Friends,

Welcome to the Benjamin Graham Value Investing Program website!

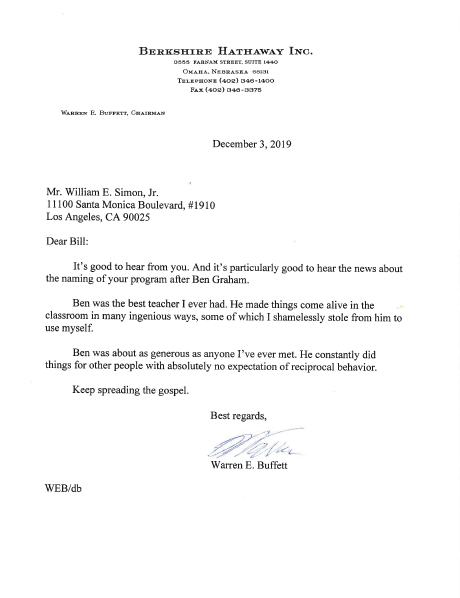

Program Co-founder Meets Warren Buffett

In December 2018, Professor Bill Simon, co-founder of the Value Investing Program, had the honor to meet super-investor Warren Buffett at his office in Omaha, Nebraska. Here, Mr. Buffett is seen holding the 2018-19 UCLA Value Investing Program t-shirt before their dinner together. On the right is the letter Mr. Buffett wrote Professor Simon on receiving the news that the Value Investing Program had been named for Benjamin Graham, Mr. Buffett’s mentor. The Program could not be more pleased to have the encouragement of Benjamin Graham’s most extraordinary student.

Value Investing Program Summary

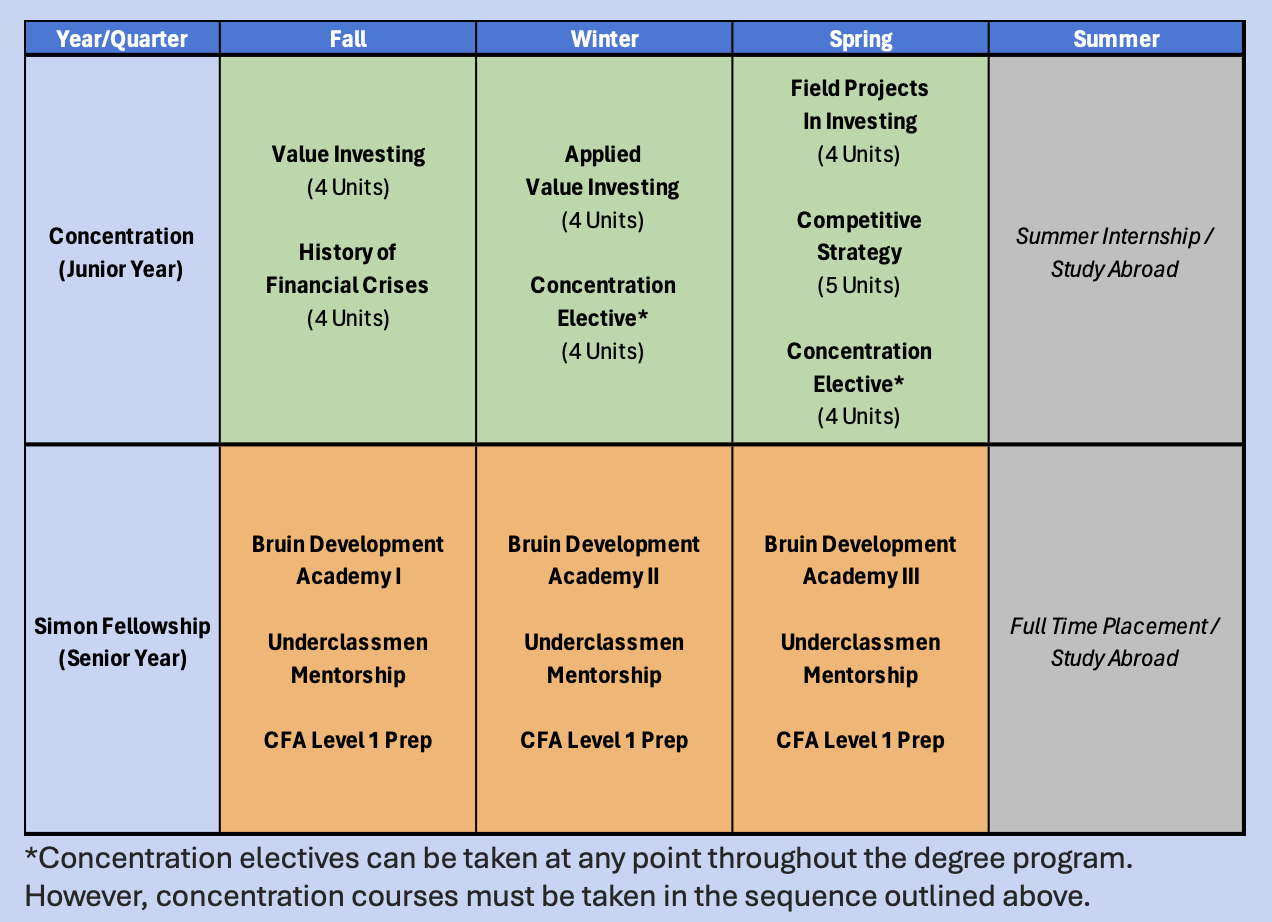

The Benjamin Graham Value Investing Program is intended to prepare undergraduates for a wide range of careers in which they will be faced with the challenge of evaluating investment opportunities and making active decisions to direct capital to enhance value. Such careers include high level executive positions within companies, careers in alternative investment firms such as private equity or distressed debt firms, or in actively managed mutual funds. A student graduating from this program will be able to understand the full set of fundamental economic and strategic forces that favor or disfavor a particular investment opportunity from both a theoretical and historical perspective.

The Benjamin Graham Value Investing Program consists of 1) an academic concentration in Value Investing consisting taught by real-world practitioners known as “Investors in Residence” and 2) the Simon Fellowship, a platform for students to develop a robust community service profile through underclassmen mentorship and events focusing on raising awareness about careers in investing.

Value Investing Program Info Session

Interested in the UCLA Benjamin Graham Value Investing Program and learning more about the 2025-2026 application process? UBS is proud to host an exciting Information Session on Thursday, May 1st, from 7:00-8:30 PM featuring Program Co-Founder, William E. Simon Jr., Adjunct Assistant Professor at the UCLA Department of Economics, and Partner Emeritus at Simon Quick Advisors. Professor Simon will discuss all aspects of the Program in great detail and answer any questions from prospective applicants. Attendees will also have the opportunity to hear different perspectives from current Value Investing concentrators. The session will be held in person at Perloff 1102. We hope to see you there!

For more information, please contact our Program Director, Humberto Merino-Hernandez.

E-mail: hmhernandez@econ.ucla.edu

Direct Line: (310) 825-3050