Lloyd and Renée Greif, and their children (Ben, Nick and Lauren) at Bruin Woods.

UCLA is ranked as the top American school for economic mobility, and there is no better example than that of Lloyd Greif. Once a full-time student and employee, he worked his way to become one of UCLA’s most prestigious alumni and one of California’s most accomplished investment bankers.

Before coming to Westwood, Greif grew up in a humble environment just a few miles away. The son of a single parent, he shared a one-bedroom apartment with his mother and older brother. When the time came for Greif to apply to colleges, he knew his options would be limited by the high price tags on many private universities. His college counselor made one recommendation: UCLA. He applied exclusively to the Westwood school and received his acceptance. However, upon coming to the university, Greif didn’t live the ‘typical college experience.’ He spent his UCLA years working 40-hours-a-week at Ralphs Grocery Co. while managing a full-time academic program, commuting to campus all four years to accommodate his busy work schedule.

For example, waking up at 11pm, he would make his way to the local Ralphs store for an early morning shift, leading the team in the process of beginning the day’s work, having taken on a role on the graveyard shift, first as a clerk, and then as grocery manager. Finished by 9 am and in a classroom by 10, he would begin his classes at UCLA. This was a typical day for Greif during his four years at UCLA. Today, he jokingly boasts, “I never needed to sleep much to get good grades!” But while the times were tough and his sleep was slim to none, that didn’t stop him from becoming a top performer in school and graduating right on schedule

But Greif’s path at UCLA wasn’t necessarily simple; he didn’t decide until his last year to get his degree in economics. After testing the waters of political science, Greif realized that studying election trends didn’t appeal to him and he instead turned to economics with the guidance of his Ralph’s store manager. For Greif, economics wasn’t just an academic subject; it was a way of thinking and navigating life experiences. The undergirding principles of supply and demand resonated with his approach to life and business, and he found himself squeezing in the majority of his upper division courses during his senior year to finish on time.

After graduating, the same manager told Greif about an opportunity to study food industry management at USC on a Ralph’s scholarship. He applied for the program and ultimately graduated with an MBA from the Marshall School of Business. Greif says the degree opened doors for him as he entered the corporate world and became a management consultant at Touche Ross (now Deloitte). During this time, he simultaneously worked as a consultant during the day and earned his law degree from Loyola Law School at night, completing a trifecta of degrees from Los Angeles’ top three universities.

After two years, Greif was recruited by the investment banking firm of Sutro & Co. a meritocratic workplace that would enable him to climb the ladder of investment banking. Greif says about the transition: “I took to investment banking like a duck takes to water. I mean, it was a hand in glove fit for me.” Within six months, he brought in his first client, and he ushered in another client six months later, a feat rarely accomplished by new, junior-level hires. Before long, Greif was the top performing employee at Sutro and became the firm’s vice chairman and head of investment banking. Today, Greif advises current students on the importance of working in a meritocratic environment where you will be rewarded and advance according to your skills and work ethic.

In 1992, Greif left Sutro to form his own investment bank, Greif & Co., with a founding principle originating from Luke 6:31 of the Bible: “Do unto others as you would have them do unto you.” As an investment bank specializing in serving entrepreneurs, solely focusing on the client’s best interests became a critical component to the success and ethics of Greif’s firm. Greif & Co. offers a variety of services to its clients, from raising debt and equity financings to arranging mergers and acquisitions. Although Greif’s investment bank has an extensive breadth of professional achievements to boast of, he takes exceptional pride in its integrity and morality. Unlike numerous financial institutions that have been engulfed in scandals, Greif & Co. has earned its reputation of transparency and trustworthiness. Understanding that integrity in business is something that requires constant effort and vigilance, he has made it abundantly clear to prospective business professionals that if “you cast your bread on the water, it will come back to you.” Greif also gives back to his community, as past Chairman of the Los Angeles Economic Development Corporation and a member of the Board of Directors of the California Chamber of Commerce. Greif is one of the few members of his industry who is actively engaged in civic, philanthropic and political affairs, working collaboratively with government agencies to create the framework for a more robust and just society.

In 2019, Greif was asked to deliver the commencement speech for UCLA’s Department of Economics, an opportunity to share his wisdom with the graduating class and a unique honor bestowed on the field’s most influential figures. When speaking to the next generation of Bruin professionals, Greif stressed the importance of ethical business practices and the gravity of putting your client’s interests first. “There are no gray areas in business, just like there are no gray areas in life,’’ Greif said in our interview. “You know when you’re doing the right thing because your conscience tells you, and you know when you’re doing the wrong thing. It doesn’t matter if anybody else is looking. You’re looking and you know it.” Greif returned this year to deliver a virtual commencement speech for UCLA’s Centennial celebration.

He fondly reflects on his time as a Bruin, and more particularly, his time spent at Bruin Woods, UCLA’s family resort in Lake Arrowhead. For roughly a decade, Greif and his family spent a week every summer at Bruin Woods making friends with other alumni and taking time to relax. For him, Bruin Woods was pure family time, a week where even the adults were true campers, and it’s an experience he recommends to all Bruins.

As for young Bruins looking to follow in his professional footsteps, Greif leaves them with some simple, yet meaningful advice: “It’s important to maintain your own moral compass. Don’t let the industry you’re in or what other people do have any negative influence on you. Let your conscience be your guide. You’ll sleep well at night knowing you did right by your clients and did the absolute best job you could for them.”

Written by Katia Arami and Andreas Papoutsis

Bond Liquidity During the Covid-19 Crisis

/in Research Spotlight /by Simon BoardPierre-Olivier Weill

The COVID-19 pandemic has wrought havoc on the global economy. To cope with this unprecedented economic shock, many large US corporations turned to the $10 trillion corporate bond market. However, with the prospect of downgrades and possible defaults, along with widespread outflows from corporate bond funds, reports of illiquidity began to surface very early on: in mid-March, 2020, former Federal Reserve chairs Bernanke and Yellen described the corporate bond market as “under significant stress”, while a report from Bank of America deemed the market “basically broken”. In response, the Federal Reserve introduced several facilities designed to bolster liquidity and reduce the costs and risks of intermediating corporate debt, including the Primary Dealer Credit Facility (PDCF) and the Primary and Secondary Market Corporate Credit Facilities (PMCCF and SMCCF, respectively). The latter two facilities represented a particularly bold intervention, in that they allowed the Fed, for the first time, to make outright purchases of investment-grade corporate bonds issued by US companies, along with exchange-traded funds (ETFs) that invested in similar assets.

“Corporate Bond Liquidity During the COVID-19 Crisis” is an empirical study of trading conditions in the US corporate bond market in response to the large economic shock induced by the COVID-19 pandemic, as well as the impact of the unprecedented interventions that followed. This study is co-authored by a team including UCLA faculty as well as current and former UCLA PhD students: Mahyar Kargar (University of Illinois faculty, former UCLA Anderson PhD student), Ben Lester (Senior economic advisor at the Federal Reserve Bank of Philadelphia), David Lindsay (UCLA PhD student), Shuo Liu (Tsinghua University, former UCLA PhD student), Professor Pierre-Olivier Weill (UCLA faculty), and Diego Zúñiga (UCLA PhD student).

A key contribution of this study is to consider both the cost and the quality of intermediation services provided. More specifically, it distinguishes between two types of transactions offered by dealers. First, fast transactions called “risky-principal” trades, that occur when dealers trade immediately in and out of their bond inventory. Second, slow transaction called “agency” trades, that occur when dealers do not trade from their inventory, but instead try to locate a trading counterparty for their customers (acting very much like real estate agents).

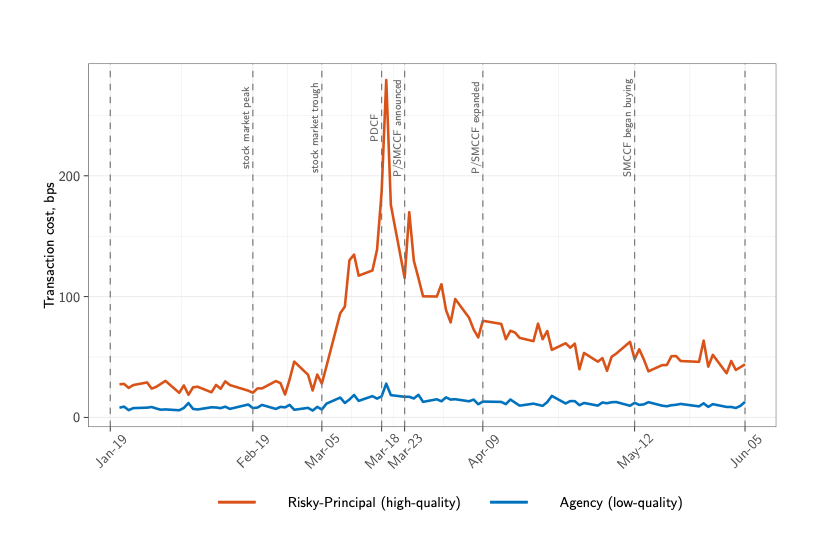

Using data from the Trade Reporting Compliance Engine (TRACE) made available by the Financial Industry Regulatory Authority (FINRA) the study separately measures the costs of risky-principal and agency trades. As shown in the Figure, the cost of risky-principal trades increased significantly during the COVID-induced panic, reaching a peak of more than 200 basis points (bps), while the cost of agency trades increased much more modestly. As the premium paid for risky-principal trades increased, the study documents that the fraction of total volume executed as agency trades increased by as much as 15% at the height of the sell-off. This implies that the average trade was not only more expensive, but also more likely to be of lower quality. This highlights the importance of studying both the cost and quality of intermediation services: simply measuring the behavior of average transaction costs during this period would underestimate the deterioration in market liquidity.

As trading shifted from risky principal to agency transactions, the study shows that, somewhat astonishingly, the dealer sector as a whole absorbed no inventory, on net, during the most tumultuous period of trading. Hence, when the demand for transaction services surged, it was customers themselves that ultimately stepped up to provide additional liquidity. In fact, it was only after the announcement of the Federal Reserve’s interventions that dealers began to absorb inventory onto their balance sheets, and trading conditions started to improve. Indeed, after the announcement of the Fed’s credit facilities until June 2020, the quantity of corporate debt held by dealers more than doubled, relative to pre-COVID levels. At the same time, the cost of risky-principal trades decreased significantly, to approximately double the levels observed before the pandemic.

To establish the causal effect of the intervention on market liquidity, the paper exploits restrictions on the types of bonds that could be purchased through the Fed’s corporate credit facilities: it shows that, immediately after the announcement of the SMCCF, the cost of trading bonds that were eligible for purchase by the Fed decreased substantially, while the cost of trading ineligible bonds was essentially unchanged. Later, when the program was expanded in both size and scope, we show that the trading costs of all bonds fell. Hence the initial announcement induced dealers to purchase eligible bonds at a lower cost, while the expansion of the corporate credit facility appears to have relaxed balance sheet constraints more generally, making dealers less reluctant to purchase any bond.

Anastasia Bogdanova

/in Alumni Interview /by Simon BoardAnastasia Bogdanova

“All these equations and graphs, how often am I going to use them at work anyway?”

More likely than not, this question will have crossed your mind at some point in your undergraduate career, especially when you’re scratching your head over an elusive concept in lectures or working through pages of dense problem sets. But the answer to this question: way more often than you’d expect! For some, like UCLA Economics alumna and economic consultant Anastasia Bogdanova, analytical frameworks and models are relevant every single day. Anastasia’s story is a perfect testament of how things you learn in the classroom can translate seamlessly into tangible and valuable skills in your professional career later on.

Like many of us Bruins, Anastasia’s journey at UCLA began as a junior transfer student from City College of San Francisco. She was captivated by the buzzing community the moment she set foot on the Hills of Westwood. “It truly felt like home,” she recalls while discussing her first encounter with our beloved campus. Between the breathtaking scenery and vibrant conversations, her mind was made up in a heartbeat. “It was exciting to imagine myself being a future student here!” Upon arriving in Southern California, she did not waste a single minute before immersing herself in the quintessential college experience. Getting on a rooter bus to the Rose Bowl amidst an energized stream of blue and gold, going on spontaneous trips to Westwood to discover new restaurants or wave to celebrities at movie premieres, and studying with floormates in the dorm lounge were all experiences that left lasting memories. It is often not until we step out of the college bubble and into the “real world” that we realize we’ll never get to live this life again, and to Anastasia, these memories are held dear to heart.

Equally treasured are the wonderful classmates she met and the lifelong friendships she forged in Westwood. Whether it was learning to speak French at the Cercle Francophone, helping organize events at the USAC Office of the President, or simply reflecting on life’s ups and downs during a meal with friends in the dining halls, she was always surrounded by people who cared deeply about each other and the world around them.

Initially a business major in community college, Anastasia developed a particular interest in economics. At UCLA, she enrolled in honors seminars on applied econometrics and microeconomics, which she credits with giving her a first look at what rigorous economic research was like. Anastasia also remembers being in Econ 167 – Victims and Villains; Panics and Bubbles taught by professors Andy Atkeson and William Simon, which was more relevant than ever in the immediate aftermath of the Great Recession of 2008. Exploring all the mechanisms at work behind the scenes, she was fascinated by the interplay between economic theory and real-world phenomena. She decided to pursue a Master’s degree in the field to advance her understanding of theoretical and applied economics.

Graduate school applications can be a daunting experience for anyone. Anastasia’s secret: knocking on professors’ doors. “Don’t be intimidated to reach out and ask for help or advice, even if you are in a class with 200 or 300 other students!” These conversations turned out to be an important factor contributing to her successful admission to Duke University’s M.A. Economics program. She gratefully recalls how the faculty supported her throughout the application process, in particular by sharing lessons learned throughout their own experiences.

Two years later, Anastasia ventured out into the professional world, and economic consulting enabled her to combine and apply the skills gained at UCLA and Duke. She moved back to the City of Angels and joined Analysis Group, one of the largest economic consulting firms. Compared to the more strategy-centered nature of management consulting, an economic consultant’s work often occurs within the context of litigation proceedings and can involve analyzing data, applying econometric and statistical models, and examining events. One of her favorite aspects of the job is the breadth of industries she’s exposed to. Since beginning her career at the firm, Anastasia has worked on cases in areas ranging from healthcare to finance, and so on. “There’s no typical day,” she said, with each new project bringing about fresh questions and opportunities for growth.

For Anastasia, learning never stops. A few years into her professional career, she returned to UCLA by enrolling in the Data Science certificate program at the extension school. Indeed, the sense of nostalgia never left. Amidst a busy work schedule, she still finds time to stop by her alma mater every now and then. “It’s always been like that for me … Westwood always felt like a great place to be.”

Her story is one of a dedicated student turned successful professional who found passion inside the classroom and shaped it into a thriving career in the professional sphere. So, for any Bruin feeling hopeless amid endless problem sets, you can take solace in knowing that hard work, paired with passion and dedication, always pays off.

Written by Simon Dong

Announcing New Marketing Video for UCLA Economics!

/in News /by Stephanie FergusonWith the help from UCLA Partnership, the UCLA Department of Economics is excited to announce the newly created and published Introduction to the UCLA Economics Department marketing video. This project has been months in the works–but we are super proud of this final product that we can share with all of you! Thank you to everyone who helped make this video possible!

Moshe Buchinsky Named 2020 Econometric Society Fellow

/in News /by Stephanie FergusonMoshe Buchinsky was recently named a 2020 Econometric Society Fellow. The Econometric Society is one of the most prestigious learned society in the field of economics, with a world-wide membership. Its main object is to promote studies that aim at a unification of the theoretical and empirical approach to economic problems and that are penetrated by constructive and rigorous thinking similar to that which has come to dominate in the natural sciences. It operates as a purely scientific organization, without any political, social, financial or nationalistic allegiance or bias. The society is run by the Fellows who choose the constitution and elect the leadership. In turn, the leadership runs the journals of the society (Econometrica, Theoretical Economics, Quantitative Economics), and a series of conferences around the world. There are currently around 700 Fellows across the globe.

Rosa Matzkin elected VP of the Econometric Society

/in News /by Stephanie FergusonRosa Matzkin has been elected Second Vice-President of the Econometric Society. She will presumably become First Vice-President in 2022 and President in 2023.

The Econometric Society is an international society for the advancement of economic theory in its relation to statistics and mathematics. Officers and New Fellows are elected each year by the current Fellows. There are about 700 Elected Fellows of the Econometric Society.

The main activities of the Society are:

Martha Bailey awarded Russell Sage and NIH Grants

/in News /by Stephanie FergusonOne of our newest faculty members, Martha Bailey, is hitting the ground running at UCLA with the funding of two new research proposals.

The first is for the project, “Measuring Intergenerational Mobility in the US over the 20th Century,” funded by the Center for Equitable Growth and the Russell Sage Foundation. The project aims to quantify national rates of intergenerational mobility in terms of occupation, income and education for the early 20th Century using Social Security Administration SS5 data that includes all states as well as women and men (because the records contain women’s married and birth names). The project uses machine learning to generate large enough samples to allow the researchers to correlate early 20th century policies and area characteristics with geographic variation in intergenerational mobility, similar to Chetty et al.’s Opportunity Atlas for the modern period.

In addition, M-CARES, a randomized control trial evaluating the role of out-of-pocket costs on women’s choice of contraceptive method, has been funded by the National Institutes of Health. M-CARES aims to evaluate the role of the price of contraceptives in women’s choice of contraceptive method, unintended pregnancy, and her life outcomes. The NIH allows the researchers to recruit a larger sample to study how unintended pregnancy affects the lives of older children, including their health, educational achievement, and wages.

Congratulations, Martha!

Welcoming 7 New Faculty Members!

/in News /by Stephanie FergusonThe UCLA Department of Economics is excited to announce that we are welcoming 7 new faculty members to our department for the 2020-2021 academic year. We are excited to have them join our ranks and welcome them all to Los Angeles! For more information about each of the new faculty members, click below:

Martha Bailey

Professor

Labor Economics

Natalie Bau

Assistant Professor

Development, Industrial Organization

Daniel Haanwinckel

Assistant Professor

Applied Microeconomics, Development, Labor Economics

Juliana Londono-Velez

Assistant Professor

Development, Labor Economics, Public Economics

Michael Rubens

Assistant Professor

Industrial Organization

Yotam Shem-Tov

Assistant Professor

Applied Econometrics, Labor Economics, Public Economics

Chris Surro

Assistant Adjunct Professor

Macroeconomics

How much is Amazon worth to you?

/in News /by Stephanie FergusonProfessor Lee E. Ohanian and Jesus Fernandez-Villarverde were recently featured in The Hill on September 6, 2020 for their opinion piece regarding the success of Amazon and it’s place in our current economy.

Excerpt:

Jeff Bezos, founder of Amazon and owner of about 11 percent of Amazon stock, recently became the first person in history to be worth more than $200 billion. Bezos’s net worth has skyrocketed as Amazon’s share price increased about 85 percent since February, before the pandemic.

Bezos’s success, however, is not toasted in all quarters. Many despise that Bezos grows wealthier while many others are suffering during the pandemic. Just last week, protesters set up camp outside Bezos’s house with guillotine in hand, demanding that Bezos share his wealth and pay Amazon workers a $30 per hour minimum wage.

Continue Reading

Do Youth Employment Programs Work?

/in Research Spotlight /by Simon BoardAdriana Lleras-Muney

According to the Bureau of Labor Statistics, about 10% of workers today are unemployed. This rate however is at least twice as high among those ages 15-25. This pattern is not unique to today. In fact, youth unemployment rates have always been much higher than unemployment rates for the rest of the population, at least since 1948 when official statistics started reporting unemployment rates. For this reason, many federal and local governments around the world have designed and implemented youth training programs to help unemployed young people. Although there is a great deal of variety in the design of these training programs the basic idea is to provide youth with work experience in the hope this experience will help them in the labor market.

A large literature has investigated whether these programs are effective. The consensus today, based on hundreds of studies, including randomized experiments, suggest that these programs have at beast modest effects on the employment and wages of participants. In fact, many question whether these gains justify the cost, and have called for the elimination of these programs today. For example, the largest youth training program in the US today is Job Corps, a federal program that spends 1.7 billion dollars annually, has been deemed a failure by critics. However, most job training program evaluations focus only on short- and medium-term outcomes. In fact, most evaluations have only followed participants for less than three years. Moreover, they have considered impacts on employment and earnings only.

In Do Youth Employment Programs Work? Evidence from the New Deal (NBER Working Paper 27103), Professor Adriana Lleras-Muney and her co-authors (Anna Aizer, Shari Eli and Keyoung Lee) study the lifetime effects of the first youth training program in the US implemented during the Great Depression, when youth unemployment rates were estimated to be around 60%. She shows that just under 10 months’ enrollment in the Depression-era Civilian Conservation Corps (CCC) increased lifetime earnings for disadvantaged young men by an average of 4.6 percent, even though it had no measurable effect on short-run labor market activity. The CCC also improved long-term health and survival. CCC men who trained for one year lived almost one more year as a result.

Between 1933 and 1942, the CCC employed about 3 million men in 2,600 camps. Created to address high youth unemployment rates by providing “relief through work,” its laborers contributed to public works projects such as developing national parks, preserving forests, and construction of land irrigation systems. CCC enrollees were unemployed and unmarried men, who were American citizens aged 17 to 25 and in good health.

After completing six months of training in camps, CCC enrollees could reenlist for another three 6-month periods. Participants were paid $30 per month and were required to send $25 to a designated family member. Enrollees were posted in camps of about 200 people, where they received meals and medical treatment such as vaccinations. In addition, enrolled men could receive formal and informal schooling at the camps.

The data for the study were constructed using CCC administrative records in state archives of Colorado and New Mexico. The records include information on 28,343 men who enrolled in the CCC between 1937 and 1942, including dates of birth, family information, enrollment data, camp assignment, reason for separation from the program, and some physical data. The data were them merged to 1940 census records, WWII enlistment records, death certificates and Social Security Administration records.

For those who lived to age 45, an additional year of training increased the age at death by one year. Life expectancy for this group was 73.6 years of life. Short-term employment results for the 4,000 men who participated in the CCC before 1940 and could be matched to the 1940 census showed that although training increased geographic mobility by about 15 percent, it had negligible effects on earnings or weeks worked. Individuals who trained for longer were not taller at the time of enlistment. But for the 5,500 men who could be matched to World War II enlistment records, a year of CCC training was associated with an additional inch in height, an indicator of better health.

Men who participate in the modern federal Job Corps (JC) program are similar to the CCC participants in age, duration of enrollment, and reasons for leaving the program. Lleras-Muney and co-authors conclude that the lessons from the CCC may therefore carry over to current Job Corps participants. Like CCC participants, JC participants obtained more education, reported being healthier and were more likely to move after their training. Thus, based on the CCC results, it is likely that JC participants will also live longer lives as a result of JC participation

Lloyd Greif

/in Alumni Interview /by Simon BoardLloyd and Renée Greif, and their children (Ben, Nick and Lauren) at Bruin Woods.

UCLA is ranked as the top American school for economic mobility, and there is no better example than that of Lloyd Greif. Once a full-time student and employee, he worked his way to become one of UCLA’s most prestigious alumni and one of California’s most accomplished investment bankers.

Before coming to Westwood, Greif grew up in a humble environment just a few miles away. The son of a single parent, he shared a one-bedroom apartment with his mother and older brother. When the time came for Greif to apply to colleges, he knew his options would be limited by the high price tags on many private universities. His college counselor made one recommendation: UCLA. He applied exclusively to the Westwood school and received his acceptance. However, upon coming to the university, Greif didn’t live the ‘typical college experience.’ He spent his UCLA years working 40-hours-a-week at Ralphs Grocery Co. while managing a full-time academic program, commuting to campus all four years to accommodate his busy work schedule.

For example, waking up at 11pm, he would make his way to the local Ralphs store for an early morning shift, leading the team in the process of beginning the day’s work, having taken on a role on the graveyard shift, first as a clerk, and then as grocery manager. Finished by 9 am and in a classroom by 10, he would begin his classes at UCLA. This was a typical day for Greif during his four years at UCLA. Today, he jokingly boasts, “I never needed to sleep much to get good grades!” But while the times were tough and his sleep was slim to none, that didn’t stop him from becoming a top performer in school and graduating right on schedule

But Greif’s path at UCLA wasn’t necessarily simple; he didn’t decide until his last year to get his degree in economics. After testing the waters of political science, Greif realized that studying election trends didn’t appeal to him and he instead turned to economics with the guidance of his Ralph’s store manager. For Greif, economics wasn’t just an academic subject; it was a way of thinking and navigating life experiences. The undergirding principles of supply and demand resonated with his approach to life and business, and he found himself squeezing in the majority of his upper division courses during his senior year to finish on time.

After graduating, the same manager told Greif about an opportunity to study food industry management at USC on a Ralph’s scholarship. He applied for the program and ultimately graduated with an MBA from the Marshall School of Business. Greif says the degree opened doors for him as he entered the corporate world and became a management consultant at Touche Ross (now Deloitte). During this time, he simultaneously worked as a consultant during the day and earned his law degree from Loyola Law School at night, completing a trifecta of degrees from Los Angeles’ top three universities.

After two years, Greif was recruited by the investment banking firm of Sutro & Co. a meritocratic workplace that would enable him to climb the ladder of investment banking. Greif says about the transition: “I took to investment banking like a duck takes to water. I mean, it was a hand in glove fit for me.” Within six months, he brought in his first client, and he ushered in another client six months later, a feat rarely accomplished by new, junior-level hires. Before long, Greif was the top performing employee at Sutro and became the firm’s vice chairman and head of investment banking. Today, Greif advises current students on the importance of working in a meritocratic environment where you will be rewarded and advance according to your skills and work ethic.

In 1992, Greif left Sutro to form his own investment bank, Greif & Co., with a founding principle originating from Luke 6:31 of the Bible: “Do unto others as you would have them do unto you.” As an investment bank specializing in serving entrepreneurs, solely focusing on the client’s best interests became a critical component to the success and ethics of Greif’s firm. Greif & Co. offers a variety of services to its clients, from raising debt and equity financings to arranging mergers and acquisitions. Although Greif’s investment bank has an extensive breadth of professional achievements to boast of, he takes exceptional pride in its integrity and morality. Unlike numerous financial institutions that have been engulfed in scandals, Greif & Co. has earned its reputation of transparency and trustworthiness. Understanding that integrity in business is something that requires constant effort and vigilance, he has made it abundantly clear to prospective business professionals that if “you cast your bread on the water, it will come back to you.” Greif also gives back to his community, as past Chairman of the Los Angeles Economic Development Corporation and a member of the Board of Directors of the California Chamber of Commerce. Greif is one of the few members of his industry who is actively engaged in civic, philanthropic and political affairs, working collaboratively with government agencies to create the framework for a more robust and just society.

In 2019, Greif was asked to deliver the commencement speech for UCLA’s Department of Economics, an opportunity to share his wisdom with the graduating class and a unique honor bestowed on the field’s most influential figures. When speaking to the next generation of Bruin professionals, Greif stressed the importance of ethical business practices and the gravity of putting your client’s interests first. “There are no gray areas in business, just like there are no gray areas in life,’’ Greif said in our interview. “You know when you’re doing the right thing because your conscience tells you, and you know when you’re doing the wrong thing. It doesn’t matter if anybody else is looking. You’re looking and you know it.” Greif returned this year to deliver a virtual commencement speech for UCLA’s Centennial celebration.

He fondly reflects on his time as a Bruin, and more particularly, his time spent at Bruin Woods, UCLA’s family resort in Lake Arrowhead. For roughly a decade, Greif and his family spent a week every summer at Bruin Woods making friends with other alumni and taking time to relax. For him, Bruin Woods was pure family time, a week where even the adults were true campers, and it’s an experience he recommends to all Bruins.

As for young Bruins looking to follow in his professional footsteps, Greif leaves them with some simple, yet meaningful advice: “It’s important to maintain your own moral compass. Don’t let the industry you’re in or what other people do have any negative influence on you. Let your conscience be your guide. You’ll sleep well at night knowing you did right by your clients and did the absolute best job you could for them.”

Written by Katia Arami and Andreas Papoutsis